tax fraud lawyer salary

Tax Attorney Salary and Earning Potential. Tax lawyers see strong consistent earnings.

How To Choose A Post Conviction Attorney Federal Criminal Law Center

Some states allow lawyers to take continuing education credits through.

. Learn more about. According to Glassdoor the average annual base pay for tax lawyers in the United States is 133580. Submit Form 3949-A Information Referral online PDF if you suspect an individual or a business is not complying with the tax laws.

Freehold NJ Stockbroker Investment Fraud Attorney 732 863-5050. Cookstown Stockbroker Investment Fraud Lawyers. The United States Department of Labor Bureau of Labor Statistics BLS reported that the median annual income for a lawyer in 2020 was 126930 while the top ten percent earned more than 208000.

The average salary for Entry Level Tax Attorney in New York City NY is 157000. You wont receive a status or progress. By litigating these cases our lawyers play an essential role in developing federal tax law and in assuring the American public that everyone pays the tax they owe in accordance with the law.

36 open jobs for Tax lawyer in New York. Report Suspected Tax Law Violations. Youll be a proactive decision-maker.

This data is based on 987 survey responses. The average Tax Attorney IV salary in the United States is 202512 as of July 26 2022 but the range typically falls between 174833 and 232032. Taxes and tax fraud and healthcare.

Granted where you end up practicing will heavily impact your earnings. By understating his income on his tax returns Johnson and DAPI paid little to no income tax for tax years 2012 2013 and 2014. The salary of most tax lawyers is often determined by billable hours.

We dont take tax law violation referrals over the phone. We will keep your identity confidential when you file a tax fraud report. Claimed Lawyer Profile Social Media.

The United States Bureau of Labor Statistics estimates the annual salary of a lawyer to be 120910. Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. As well as cases involving financial fraud health care fraud organized.

Lydon and Trial Attorney Tim Russo of the Tax Division are prosecuting the case. Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. As a Specialist youll leverage the latest in mini and micro computers telecommunications and data management systems.

These numbers represent the median which is the midpoint of the ranges from our proprietary Total Pay Estimate model and based on salaries collected from our users. The average salary for a Tax Attorney is 101670. The average Healthcare Lawyer salary in the United States is 88563 as of July 26 2022 but the salary range typically falls between 78889 and 98769.

Average tax lawyers can expect to make slightly more than that amount. This case is the product of an investigation by the Internal Revenue Service Criminal Investigation. Tax lawyers handle a variety of tax-related issues for individuals and corporations.

Working at a larger company or in an urban area will drive up your salary significantly. The estimated total pay for a Tax Attorney is 137864 per year in the Chicago IL Area area with an average salary of 119202 per year. Deane School of Law at Hofstra University Rutgers University - New BrunswickPiscataway New Jersey and New York.

That could mean tax lawyers will have to keep track of every minute of work they do for clients. Jason Adam Volet. Entry-Level Attorney Opportunities Salaries Benefits and Promotions.

Tax Law Specialists have GS-57911 career ladders - which means they can enter as a grade 5 and advance to a grade 11 without further competition and later compete for higher grades. Gender Breakdown for Certified Fraud Examiner CFE Male. They may help clients navigate complex tax regulations so that clients pay the appropriate tax on items such as income profits and property.

Search Tax lawyer jobs in New York NY with company ratings salaries. Experienced Tax Fraud Lawyer. To arrange a free consultation with a Newark tax fraud defense attorney call us toll free at 866-970-0783 or contact us online.

If you or your business is facing IRS fraud charges you need to make sure your case is handled properly by a seasoned federal criminal defense attorney. Youll earn a good salary.

Irs Tax Whistleblower Protection Law Zuckerman Law

How Much Do Lawyers Make In Australia Lawyer Salary Australia Criminal Defence Lawyers Australia

Why Lawyer Salaries Are Skyrocketing

/cloudfront-us-east-2.images.arcpublishing.com/reuters/MCIYN7LS7JPIZDW7RO6NG6K2H4.jpg)

With Salaries Up To 1 Million Law Firm Marketing Pros Finally Get Some Respect Reuters

/cloudfront-us-east-2.images.arcpublishing.com/reuters/VB75ZUGITFK3HEE25KK7JJXIWY.jpg)

Cravath Joins Rush To Raise Salaries Bringing More Ny Firms Along Reuters

What Type Of Lawyers Make The Most Money Lawrina

Bitcoin Tax Attorney Experienced Us And International Tax Lawyer Cpa

What Type Of Lawyers Make The Most Money Lawrina

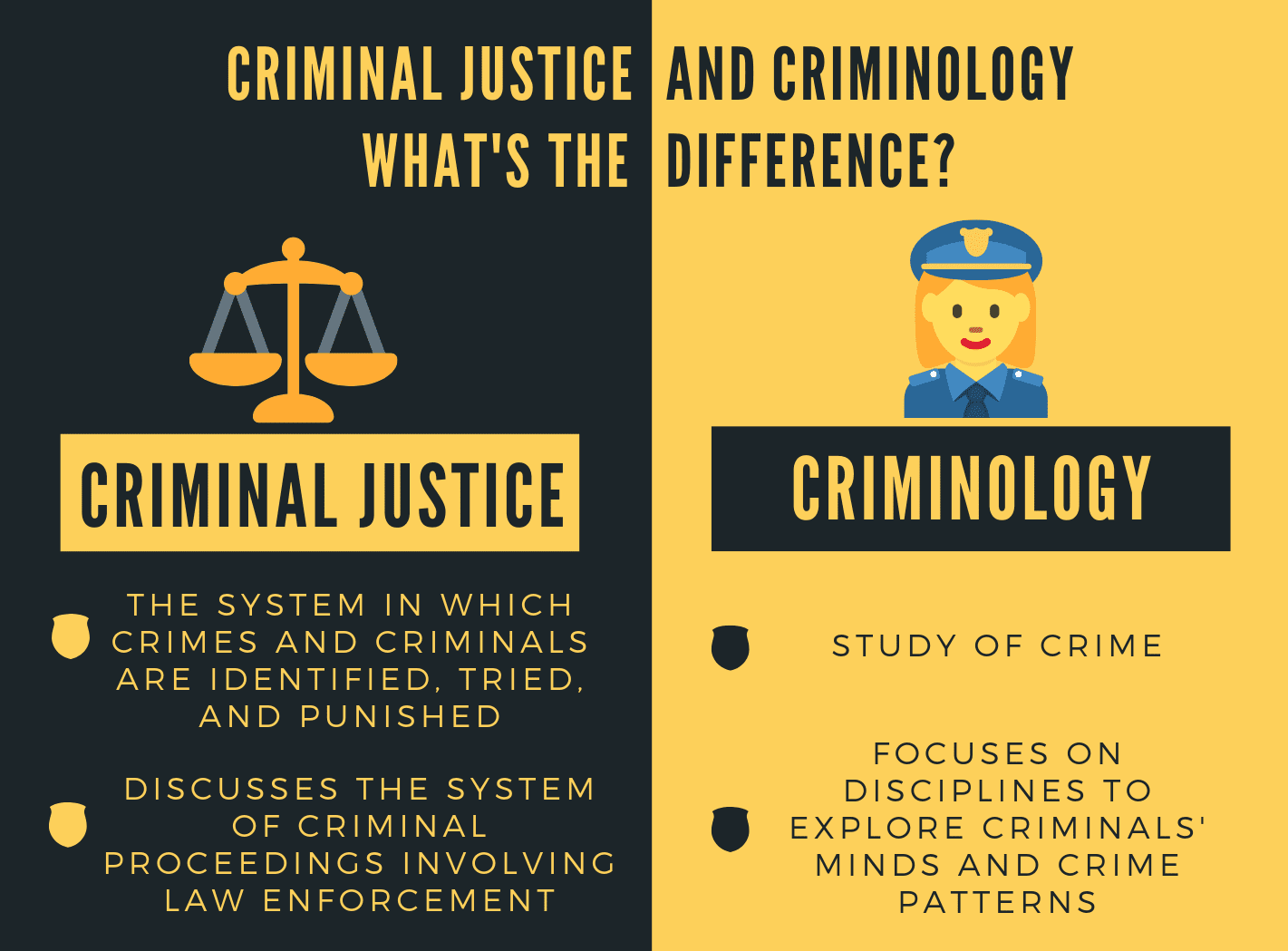

2021 Criminal Justice Career Salary And Degree Guide

Securities Lawyer Salary Comparably

Hartford Lawyer Convicted Of Felony Tax Fraud After Spending Lavishly On Himself Connecticut Law Tribune

Avarage Attorney Salary That Explosive Surprising To You Halt Org

How Much Do Lawyers Make On Average By Law Career Algrim Co

:max_bytes(150000):strip_icc()/shutterstock_248791324-5bfc35ffc9e77c002632564d.jpg)

Accounting Vs Law What S The Difference

26 Types Of Lawyers The Options And The Practice

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Biglaw Salaries Dwarf The Average Lawyer S Report Says Law360